9 Easy Facts About Burial Insurance Plans - How Final Expense Insurance Works Shown

Best Burial Insurance Companies: 17 Excellent Choices

Is burial insurance different from preneed funeral insurance? Fundamentals Explained

How We Found The Very Best Burial Insurance Coverage 30+ Hours of Research 35 Policies Examined 12 Policies Selected 22 Business Thought About 7 Companies Chose With social distancing and stay-at-home orders, numerous seniors are fighting with solitude and seclusion. We have actually developed a list of products that caretakers or seniors can acquire to help older adults stay delighted, healthy and linked, whether they are aging in place in your home or in an assisted living community.

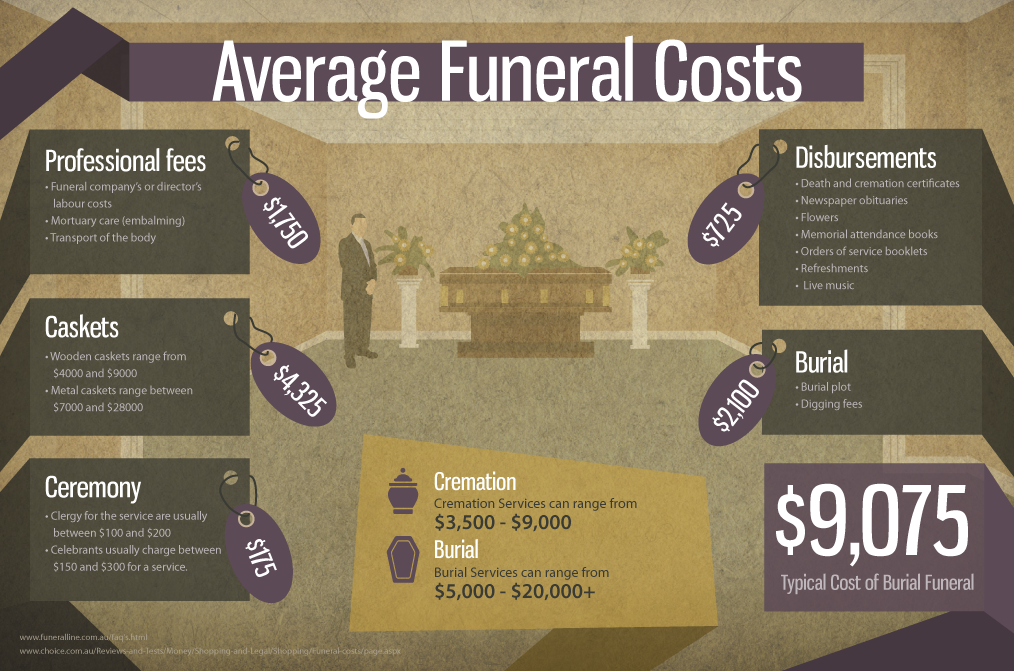

Even if you do not have actually detailed want the service kept in your honor, however, it is essential that you prepare for the expense of your funeral service. The lots of services and products required for a funeral and burial frequently total $8,000, and often much more. By getting burial insurance coverage, a special type of life insurance coverage, you can plan ahead and leave your enjoyed ones a clear way to pay for those expenses.

Best Burial Insurance Companies of 2022

Aetna Final Expense Insurance Review - Best Burial Insurance in 2021?

As you browse for a fantastic business, you might encounter policies that have stringent health requirements you can not fulfill, term life insurance policies that will expire before they can be helpful to you, or policies that have premiums that increase in time. You may likewise discover rip-offs that aim to take your individual details without delivering a genuine insurance product.

Burial Insurance Companies Reviewed - NoExam.com Fundamentals Explained

Read on to find definitions for common burial insurance coverage terms, a guide to a few of the finest companies and policies currently on the market, and answers to the most typical burial insurance coverage concerns that you have. If you aren't sure if burial insurance is the funeral planning tool for you, take a look at our Buyer's Guide to learn more about your choices.

The following fast definitions will be beneficial to you as you learn more about and compare your alternatives. Burial insurance coverage is precisely the very same as final expenditures insurance and funeral insurance. Considering that it's generally just a low survivor benefit kind of whole life insurance coverage, it might be called something that has no reference to funerals, yet still appropriate as a type of burial insurance coverage.

The individual you tell the insurance coverage company to offer the life insurance payment (death advantage) to when you are gone. You can generally designate multiple beneficiaries. Go Here For the Details is the life insurance payment that your beneficiary receives when you die. This is always a quantity that you pick in advance, and for burial insurance, it's most typically in between $5,000 and $25,000.